We Need Your Help with the Nonprofit Tax Bill Clean-up!

- Gwen Cooper

- Article

- Donors

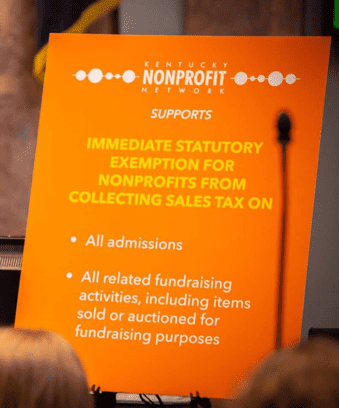

House Bill 354, an omnibus tax clean-up bill that includes language regarding nonprofits and sales tax, passed as expected out of the House on Thursday with a vote of 96-4. It now heads to the Senate, specifically the Senate Appropriations & Revenue Committee. The good news is that the bill currently exempts ALL nonprofit admissions from sales tax! But, as with most bills, there is a part of the language that still needs work for us to declare victory.

When the bill passed in the last session it triggered the unintended consequence that required all nonprofits to pay a 6% sales tax on admissions. This included galas, shows at the Kentucky Center for the Arts, tasting events, running events and just about any other “”event”” you can think of. We took care of that problem in the bill that passed the House.

But, last year’s tax bill triggered enforcement of a very old law that requires nonprofits to collect and remit tax on auctions with receipts above $1,000. For years nonprofit organizations ignored this law and the state did not enforce the law … until passage of the tax reform bill last year.

Consequently, taxes are now collected on the price of items sold at auctions; a huge burden to both the nonprofit and the donor. We are working to repeal this law in its entirety, but the authors of the bill simply upped the threshold for paying the tax to $10,000 rather than $1,000. And they thought we’d be happy, well we are not! The nonprofit sector is banning together to repeal this law as part of the omnibus tax bill.

HERE’S HOW YOU CAN HELP!

Use your voice and call your Senator at 800-372-7181 This is manned Legislative message center. A live person will answer during regular business hours and you can simply say the following:

- Hi! My name is XYZ with Hosparus Health and I’m a constituent of Senator Y. I’m calling to urge him/her to support amending House Bill 354 to remove the $10,000 threshold requiring nonprofits to collect and remit sales tax on items sold.

- By putting a threshold on the sale of auction items, you are taxing donations. As a donor, I choose to use my disposable income to donate to the charity of my choice, to help offset what our tax payer dollars don’t cover. It makes no sense to then add tax to my donation! We urge you to remove this clause in its entirety.

To find out who your Senator is click here, Type in your address and your local elected official will pop up. Once you leave your message it will get forwarded to the correct Senator. Our elected officials count the number of calls they get, and this helps influence legislation. This is important, please take five minutes and make the call.

“